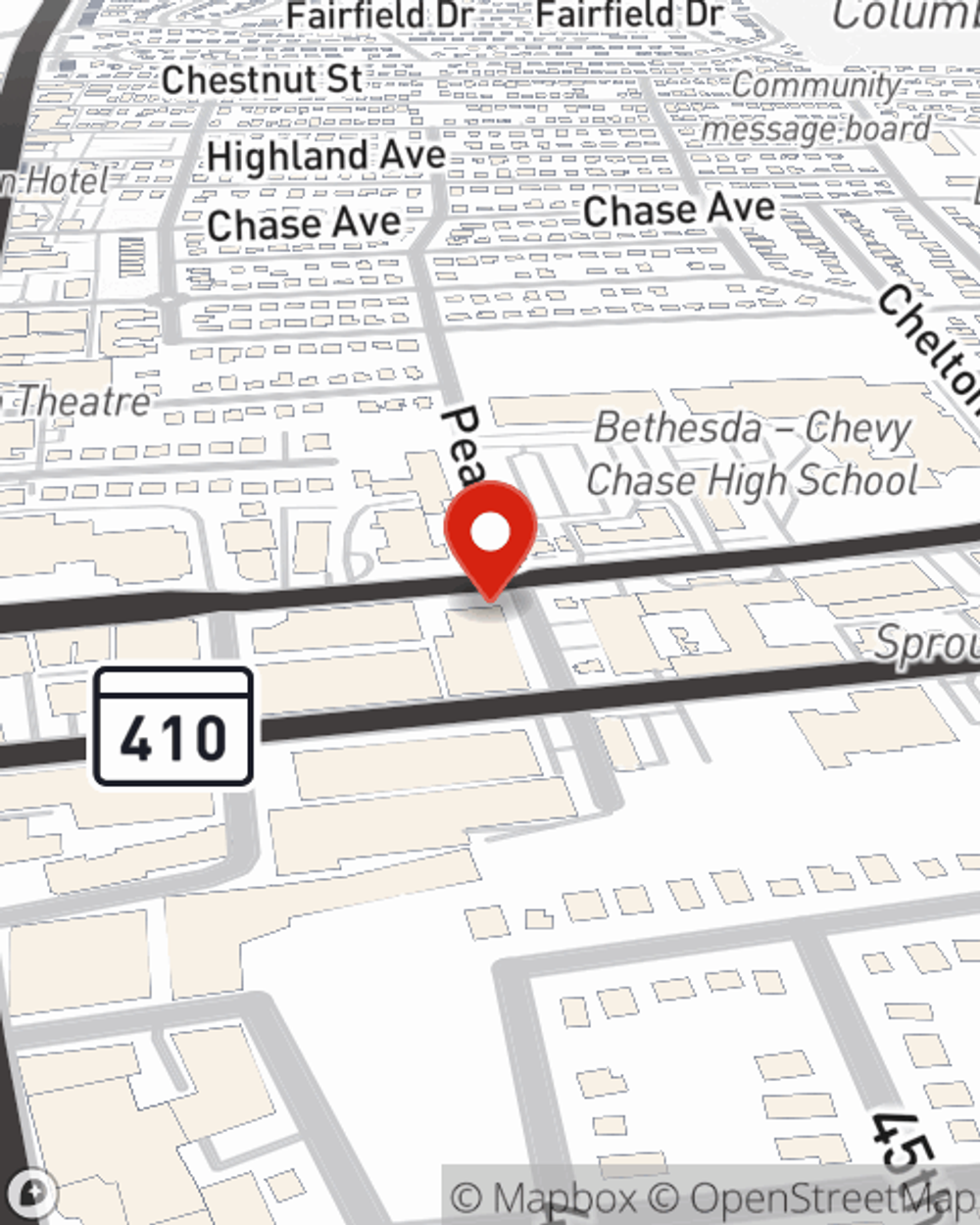

Condo Insurance in and around Bethesda

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

Calling All Condo Unitowners!

No matter your level of preparedness, the unexpected can happen. So be the condo owner who is prepared with quality insurance which may be able to help in the event of damage from theft, weight of snow, or freezing pipes.

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

Protect Your Condo With Insurance From State Farm

You can sleep soundly with State Farm's Condo Unitowners Insurance knowing you are prepared for the unanticipated with fantastic coverage that's right for you. State Farm agent Leslie Riehl can help you explore all the options, from replacement costs, a Personal Price Plan® to liability.

Reach out to State Farm Agent Leslie Riehl today to find out how a State Farm policy can help protect your townhome here in Bethesda, MD.

Have More Questions About Condo Unitowners Insurance?

Call Leslie at (301) 270-6070 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Leslie Riehl

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.